9 4: Petty Cash Business LibreTexts

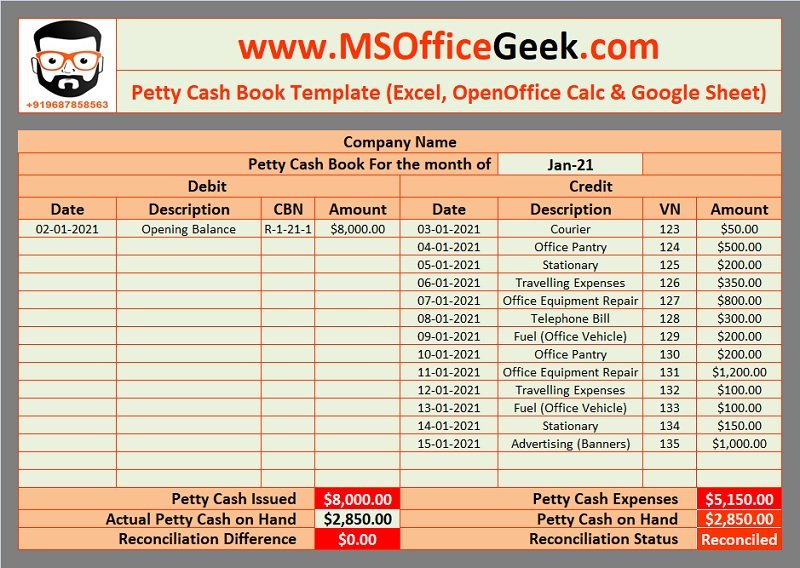

The petty cashier is always assumed to hold cash equal to the imprest account in the form of actual cash or paid-up PCVs. When a petty cashier needs money, the main cashier gives them a cheque. Record the following transactions in an analytical petty cash book for the month of January 2019. Because the cash book is updated continuously, it will be in chronological order by transaction. In the description column, the accountant writes a short description or narration of the transaction.

How to record petty cash journal entries?

The first step when creating a petty cash system is to establish a list of rules and regulations that will make up the policy governing the usage of the petty cash fund. Define clear policies that outline how petty cash can be used, including approved expenses, spending limits, and documentation requirements. The money that comes from the head accountant is recorded on the debit side.

Get a complete view of your finances with QuickBooks accounting software for small businesses

Most people use petty cash for things like buying office supplies, paying for postage, and so on. In a simple system, all petty cash expenditures are documented as they happen. The total of these costs is added to the petty cash account monthly, and the monthly amount is entered into the General Ledger as an expense. In modern business practices, it has evolved into a structured system for handling minor expenses efficiently. It’s typically managed through a petty cash fund, a fixed amount of money set aside for these small purchases. The petty cash book is seen as a debit since a petty cash account is a current asset.

How much petty cash should a business have?

In this case, you might want to consider installing a camera or taking away access until you figure out who’s stealing. Ideally, people in this role will be comfortable handling business expenses and have experience with financial statements. Those with prior financial accounting experience are especially great with this, but anyone that’s handled expense accounts should be fine. A petty cash fund is established by transferring a specified amount of cash from the general checking account to a person who is given custodial responsibility for the fund.

For this, they are required to submit a petty cash expenditure statement and a collection of all the receipts to the finance department of the company. All of the data is verified, and only then another cheque for the next time period is issued. The streamlined processes of the imprest system minimize the labor efforts required for petty cash management. This allows personnel to focus on more strategic financial tasks, improving overall operational efficiency.

Increased control and accountability

A petty cash log book can help keep temptation away from your employees. The honor system can be great under the right circumstances, but it’s much safer if all your cash is locked away in one place and accounted for. There’s usually a petty cash custodian who’s responsible for managing the amount. Either the employee or the petty cash custodian would then record the amount spent on a petty cash log, along with details like the date, amount, and purpose of the expense. Imprest system is the form of a financial accounting system which commonly use to control petty cash.

This may often require a company to hire an accountant capable of managing these accounts. Doing this might not be a problem for some businesses but may be seen as an additional expense for the company. There’s a potential risk of funds being used for unauthorized or personal expenses. This makes it very important to put stringent measures in place so as to prevent financial impropriety.

You must create journal entries that monitor and record all petty cash transactions, just like any other transaction. These transactions should be present on your financial statements and recorded in a manner that oversees the replenishment of your funds. While the actual funding should be recorded, the individual purchases do not need to be officially recorded. Every month, or as cash is needed, the custodian should summarize the petty cash log by expense account and record a journal entry debiting each expense and crediting petty cash. Every now and then, the petty cash custodian will reconcile the cash on hand against the transaction log.

- In the balance column, it will show how much cash remains within our box.

- Separate columns are used for each expense in ‘Analytical petty cash book’.

- Ask a question about your financial situation providing as much detail as possible.

- If there’s a shortage or overage, a journal line entry is recorded to an over/short account.

- This segment outlines the systematic steps involved in establishing a petty cash system, ensuring transparency, security, and efficiency in handling minor expenditures within an organization.

It works well to cover small impromptu expenses—like a tip for the kid delivering pizzas to the lunch meeting, or cab fare home for employees working late. It saves the hassle of reimbursing people or expecting them to pay out-of-pocket for work-related items. Particularly in the case of small transactions, it is often challenging to keep a track record of all the expenses that have been incurred. As a practical entrepreneur, you can’t expect everything to go your way. There will be days when unexpected business expenses occur, which can be urgent and you may have to handle them immediately. Based on the information above, fill out the fields to record the expense.

The petty cashier is given a ballpark figure of money to handle the petty cash expenses. Once that amount is exhausted, the petty chairs submit the expense record to the doubtful accounts and bad debt expenses head accountant. It is important for a business to define these categories clearly so that it helps you analyze where most of your petty cash funds are being used.

Ideally, a financial controller or a member of the finance team should be responsible for checking, reviewing, and auditing the petty cash book at a fixed interval. A petty cash book is used to record and track small, routine expenditures made in cash. It helps manage day-to-day expenses efficiently without the need for frequent checks or formal banking transactions.

Leave a Comment